Business

International Gemmological IPO subscribed 72% on Day 2 of offer

NEW DELHI: The initial public offer of diamond grading firm International Gemmological Institute (India) Ltd got subscribed 72 per cent on the second day of share sale on Monday. The initial share sale received bids for 4,24,06,035 shares against 5,85,60,902 shares on offer, as per NSE data.

Retail Individual Investors (RIIs) part got subscribed 2.44 times while the category for non-institutional investors received 83 per cent subscription. The portion for Qualified Institutional Buyers (QIBs) fetched 9 per cent subscription.

Blackstone-backed International Gemmological Institute (India) Ltd on Thursday mobilised Rs 1,900 crore from anchor investors.

The issue, with a price band of Rs 397-417 per share, will conclude on December 17.

The Rs 4,225-crore IPO is a combination of a fresh issue of equity shares worth Rs 1,475 crore and an Offer-for-Sale (OFS) valued at Rs 2,750 crore by promoter BCP Asia II TopCo Pte Ltd, an affiliate of Blackstone.

The company proposes to utilise the proceeds from the fresh issue for the acquisition of IGI Belgium Group and IGI Netherlands Group from promoter, and general corporate purposes.

International Gemmological Institute (India) Ltd provides services related to the certification and accreditation of natural diamonds, laboratory-grown diamonds, studded jewellery and coloured stones.

Axis Capital, Kotak Mahindra Capital Company, Morgan Stanley India Company and SBI Capital Markets are book-running lead managers to the issue.

The shares of the company are expected to be listed on the BSE and NSE.

Business

‘Okay to get paid less than Americans’: Entrepreneur justifies lower wages to Indian workers for overseas work

Buenos Aires-based entrepreneur Franco Pereyra has stirred a debate with his perspective on the issue of pay disparities in global remote work.

Pereyra, co-founder of Hire With Near, argued in a post on LinkedIn that paying overseas workers, from countries like India, less than their US counterparts isn’t inherently wrong. “It’s okay for global talent workers to get paid less than Americans,” he said.

India, one of the largest hubs for global remote talent, faces similar dynamics. Skilled workers in fields like IT, customer service, and marketing are often paid significantly less than their counterparts in the US or Europe, despite doing the same work. Critics argue that such pay disparities are exploitative. However, Pereyra offered his conflicting view saying, “A lot of people get upset and say workers in Latin America, India, and the Philippines are being exploited. And yes, there are certainly companies that do exploit global talent. But paying less for overseas work is not inherently wrong.”

Pereyra stayed firm on justifying the pay disparity and added, “So yes, I realize that compared to US salaries we are getting paid less to do the same job. But I get to stay in my country, be with my family, and enjoy a lower cost of living.”

He then took the argument towards economic conditions of different countries. Citing his own experience of living in the Argentina capital the entrepreneur said, “here’s the reality: The opportunity here is limited. Our country’s economy is in bad shape.” “Hopefully, my country’s economic condition will improve one day, and wages will rise,” he further said adding that “In the meantime, those with marketable skills can keep taking advantage of the opportunities that global remote work provides.”

In a separate post the startup founder acknowledged “lot of companies chase the cheapest possible labor” while viewing them as “disposable” while “giving the minimum resources to support the workers”. He claimed that the companies are “not only are they trying to pay the least, they’re also giving the minimum resources to support the workers. I see this happen way too often, especially with talent from India and the Philippines—a revolving door of workers treated as disposable.”

Franco Pereyra’s take justifying the pay-gap received severe backlash from LinkedIn users. Voicing disagreement, a user asked the Argentinian entrepreneur, “Do the people in Argentina or Brazil do less quality work than their US counterparts? Do they work less hours or produce less code? No.”

“Just another post justifying under-payment. Should the under paid worker also under deliver the work (quality or deadline misses)? Would you be happy with that?” said a LinkedIn user while another labeled this opinion as “racism and classism”.

Business

Stock market today: BSE Sensex opens in green; Nifty50 above 23,750

Stock market today: Indian equity benchmark indices, BSE Sensex and Nifty50, opened in green on Tuesday. While BSE Sensex was above 78,500, Nifty50 was above 23,750. At 9:18 AM, BSE Sensex was trading at 78,540.17, up 47 points or 0.059%. Nifty50 was at 23,767.20, up 14 points or 0.058%.

Indian markets showed a slight recovery on Monday following last week’s significant five-day decline. According to analysts, this temporary pause reflects typical market behaviour, influenced by oversold positions in major index stocks.

“Participants are advised to maintain a cautious stance with a negative bias on the index until clear signs of a rebound emerge. However, individual stocks continue to present opportunities on both sides. We reiterate our preference for the pharma and healthcare sectors for long positions, while other sectors are likely to see mixed trading trends,” said Ajit Mishra – SVP, Research, Religare Broking

Experts say that the resistance levels remain at 23,850-23,870, with a bearish gap at 24,000-24,150. Support levels exist at 23,600-23,500, with potential decline towards 23,350 if breached.

Major US indices closed higher on Monday, with both the Dow Jones Industrial Average and Nasdaq Composite achieving a third consecutive positive session. The gains were primarily driven by the performance of prominent Magnificent Seven technology companies during a trading day marked by reduced holiday volume.

Trading activity in Asian markets remained constrained within narrow bands, influenced by limited holiday participation. This followed the upward movement in US markets, which was propelled by significant technology company gains.

Gold prices remained stable ahead of Christmas holiday trading. The dollar strengthened as investors anticipated extended higher US interest rates.

FPIs sold Rs 168 crore while DIIs purchased Rs 2,228 crore worth of shares. FII net short position increased to Rs 1.56 lakh crore.

-

Sports2 days ago

Sports2 days agoJhye Richardson surprised with Boxing Day Test call-up

-

Sports1 day ago

Sports1 day agoIndia vs Australia Boxing Day Test: Everything you should know | Cricket News

-

Business1 day ago

Business1 day agoBitcoin posts its first weekly decline since Trump’s victory

-

Business20 hours ago

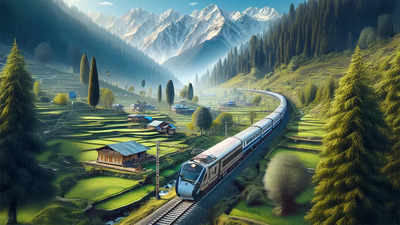

Business20 hours agoIndian Railways plans centrally heated sleeper train, special Vande Bharat chair car for Kashmir – check features

-

Business2 days ago

Business2 days agoGST panel puts off call on lower rates for insurance

-

Sports2 days ago

Sports2 days ago‘Inevitable end’: Gary Neville indicates Marcus Rashford’s Manchester United tenure could be winding down | Football News

-

Sports23 hours ago

Sports23 hours agoVijay Hazare Trophy highlights: Ruturaj Gaikwad and Krunal Pandya deliver match-winning performances | Cricket News